Value Added Tax (VAT)

As of October 14, 2014, Cable Bahamas Ltd. became a VAT Registrant and is authorised to charge and collect VAT on behalf of The Government of The Bahamas.

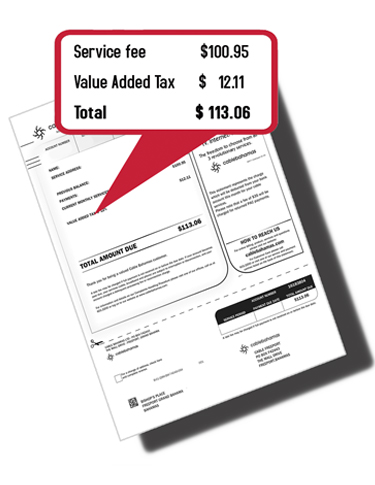

Since July 1, 2018 Cable Bahamas is required by the government to charge VAT on all REV services at a rate of 10%

Pursuant with The Value Added Tax Act 2014, this serves as a notice to our customers that Cable Bahamas Ltd. is duly registered under the act and has been assigned the following Tax Identification Numbers (TIN):

Cable Bahamas Ltd. 100000450

Cable Freeport Ltd. 100017368

As mandated by law the Tax Identification Number must be displayed on all invoices and bills remitted by a VAT Registrant. The provision of a VAT Registrant’s Tax Identification Number will permit Cable Bahamas to include the same on all bills and invoices sent to customers.

VAT Registrants can submit their TINs to Cable Bahamas Ltd via e-mail at vatadmin@rev.bs or in writing to:Cable Bahamas Ltd

Robinson Road at Marathon

P.O. Box CB 13050

Nassau, Bahamas

REV appreciates the cooperation of its customers as it seeks to comply with the VAT Legislation.